2023 brought political and economic instability for many, and the telecoms industry was triggered to re-evaluate its business models and shift its focus toward enhancing market value. This was also the year that the potential transformative power of AI started to dominate conversations both in and out of the boardroom, especially on the main stage of numerous industry events. As 2023 comes to a close and we look forward to the dawn of the New Year, below are my predictions of the key trends that will take shape in 2024.

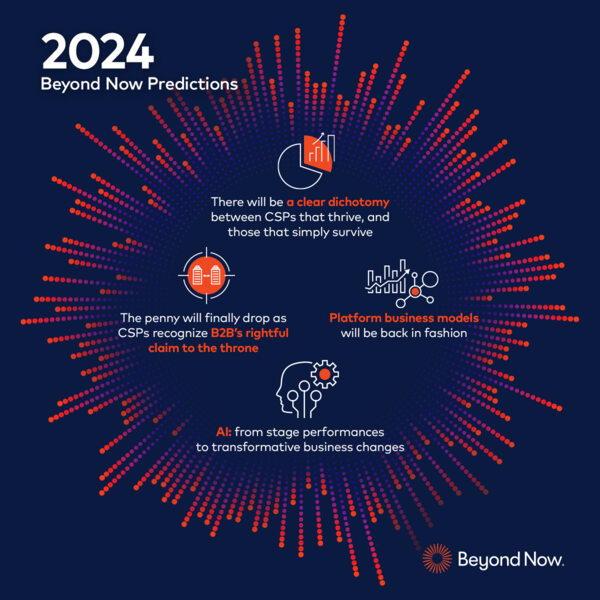

The outlook for CSPs in 2024 is harsh. Most are in pure survival mode; heavily indebted and mired by high interest rates, retiring legacy networks and systems, and pursuing cost cutting at all levels. In 2024, there will be a stark bifurcation of the industry. It will become very clear which CSPs are in trouble and which are deviating from the pack towards a stronger financial position.

Around 70% of CSPs lack strategic direction and are failing to change. Despite promised telco to techco transformations and 5G opportunities, the majority of CSPs will continue to measure themselves against insufficient KPIs like ARPU statistics. They will continue their ‘tried and tested’ focus on saturated consumer markets. The industry is lacking the deep strategy, planning and willingness to execute, while taking into account all the possible opportunities that stand before them. It's analogous to the airline industry, where price differentials are at play due to the limited opportunities to innovate on consumer products.

In contrast, the remaining 30% will have their heads above the water, steered by the right ownership structure, realistic expectations around dividend levels and a supportive shareholder community. They’ll also execute on B2B opportunities appropriately, daring to build vertical businesses, with ecosystem models at the heart of delivering innovation and solving challenges for customers, particularly in B2B.

In 2024, B2B will finally become core to CSP strategies. To date, a slavish focus on mass consumer markets has stifled CSP success. While the latest round of global CSP revenues reports demonstrates that B2B growth is outperforming B2C. TM Forum’s latest annual telco revenue growth report revealed that B2B revenues are growing faster than B2C: 5.6% versus 1.6%.

CSPs will experience a penny drop moment, driven in part by greater pressure to carve a path to growth while innovating faster and investing more quickly. Realiszation will hit that opportunities to create value for customers are too limited in B2C. And 5G for consumer will not be enough. If necessity is the mother of invention, then pressure is the mother of reinvention.

That shift in mindset will be coupled with collaboration between CSPs going mainstream. What that will look like is a connected ecosystem of telecoms, industry and technology partners, that promotes and facilitates collaboration and co-innovation to address global B2B market opportunities. Smart CSPs will look for ways to de-risk investment, and accelerate and optimize the commercialization and go-to-market of B2B solutions. This new model that centres on a coalescence of ideas will see a global CSP network tap into insights and best practices, and grow the reach of proven solutions by opening up new market opportunities and global sales channels.

Digital platforms are poised to take centre stage in 2024. While not a novel concept, they will regain prominence as businesses shift their focus toward enhancing market value. Specifically, digital platforms will re-emerge as a vital tool for CSPs to remove internal silos, enable increased efficiency and accelerate growth.

As pressure mounts and costs become higher, CEOs will take a bird’s eye view of their businesses next year, breaking down the craziness of internal silos around different inefficient business units that focus on single offerings. Where CSPs are struggling to manage their siloed investments, as money is split across business units covering 5G, Cloud and IoT – and customers are equally dissatisfied with the lack of unified, simple services.

Reality will kick in on the opportunity for digital business platforms to provide CSPs with pathways to innovate faster for adjacent or new digital products. These can be added to existing processes to compete quickly with disruptors or enable the CSP to become the disruptor themselves, while improving efficiency and growth at their core.

CSPs will place a top priority on the development of a comprehensive business platform, designed to dismantle silos and drive efficiency. They’ll use it to harness the power of enhanced visibility into digital customer lifecycles, embrace hyper-automation, fortify supply chain security, and optimize online sales strategies. This strategic shift towards a new ecosystem-based business model will serve as a catalyst for accelerating CSPs’ much desired business growth.

In 2024, the landscape of AI discussions will undergo a significant shift. Rather than the abundant onstage rhetoric, industry professionals will be drawn into meeting rooms, seeking to navigate the great opportunity artificial intelligence presents. The focus will pivot from IT leaders debating their opinions to an active change to translate their vision into tangible actions within the organization.

At large, CSPs are looking towards AI to support reductions in operating costs. But CSPs that really aim to thrive won’t let the hope behind AI disappear in an efficiency drive alone. The critical juncture lies in understanding that while operational efficiency is imperative, the potential for AI to usher in transformative changes should not be overlooked.

The ’30%’ of CSPs that we expect to have clear strategic direction on how to grow their business will emerge as true pioneers in leveraging AI. Supported by the right business models, these CSPs will harness AI not just for efficiency gains but to unlock new revenue streams, harnessing its transformative power to drive innovation and profitability.